Buying a home can be a challenge for many young Canadians. If you feel that it’s getting harder to get into the housing market, you’re not imagining things. Fluctuations in house and condominium prices and interest rates can play a huge part in a first-time homebuyer’s ability to afford a home. The new Tax-Free First Home Savings Account (FHSA) aims to make this easier by offering Canadians a way to save for a down payment for their first home.

The basics

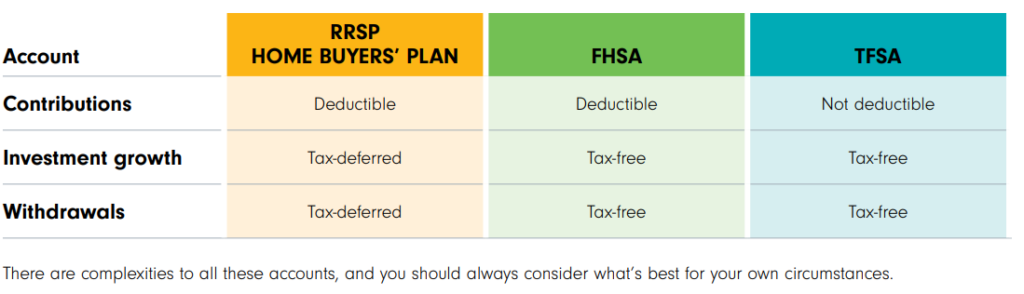

The FHSA gives prospective first-time homebuyers the ability to save $40,000 on a tax-free basis towards the purchase of a first home in Canada. Like an RRSP, contributions to an FHSA will be tax-deductible, but withdrawals to purchase a first home, including from any investment income or growth earned in the account, would be non-taxable, like a TFSA.

To open an FHSA, an individual must be a resident of Canada and at least 18 years of age. In addition, the individual must be a first-time homebuyer, meaning that they have not owned a principal residence in which they lived at any time during the part of the calendar year before the account is opened, or at any time in the preceding four calendar years.

The FHSA can remain open for up to 15 years or until the end of the year when the individual turns 71. Any savings in the FHSA not used to buy a qualifying home by this time could be transferred on a tax-free basis into an RRSP or RRIF, or could be withdrawn on a taxable basis.

Contributions

Eligible individuals will be able to contribute $8,000 annually, up to a $40,000 lifetime contribution limit. There’s a 1% per month penalty tax for any overcontributions. The annual contribution limit will apply to contributions made within a particular calendar year. Unlike RRSPs, contributions made within the first 60 days of a subsequent year can’t be deducted in the current tax year.

As with RRSPs and TFSAs, you can carry forward unused contribution room (up to a maximum $8,000 cumulative carry forward) from past years.

Like RRSP contributions, individuals won’t be required to claim the FHSA deduction in the tax year in which a contribution is made. The amount can be carried forward indefinitely and deducted in a later tax year, which may make sense if your client expects to be in a higher tax bracket in a future year.

Only the FHSA holder is permitted to claim deductions for contributions.

Withdrawals

To be able to withdraw funds from an FHSA on a non-taxable basis, certain conditions must be met. First, you must be a first-time homebuyer at the time of withdrawal, as discussed above. You must also have a written agreement to buy or build a qualifying home before Oct. 1 of the year following the year of withdrawal, and must intend to occupy that home as their principal place. The home must be in Canada.

If you meet the conditions, the entire balance in the FHSA can be withdrawn on a tax-free basis in a single withdrawal or a series of withdrawals. The FHSA must be closed by the end of the year following the first qualifying withdrawal, and you are not permitted to have another FHSA in your lifetime.

Transfers

FHSA holders will be able to transfer funds from one FHSA to another FHSA, or to an RRSP or a RRIF, all on a tax-free basis.

If funds are transferred to an RRSP or RRIF, they will be taxed upon ultimate withdrawal. These transfers won’t affect RRSP contribution room nor would they reinstate an individual’s $40,000 FHSA lifetime contribution limit.

You will also be permitted to transfer funds from an RRSP to an FHSA on a tax-free basis, subject to the FHSA annual and lifetime contribution limits. These transfers would not be tax-deductible and will not reinstate your RRSP contribution room.

Growing your down payment

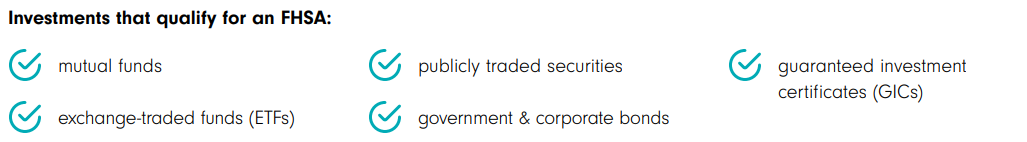

Despite its name, the FHSA can function as more than a traditional savings account. Instead, think of it as a tax-free investment account. You’ll want to take advantage of the potential tax-savings that comes from holding investments that grow in value over time. FHSAs can hold products that go above and beyond your traditional savings account. Consider investments such as mutual funds or ETFs to help maximize the growth and value of your FHSA.

Is the FHSA the best way to save for a home?

The tax advantages offered by the FHSA can make it the most tax-efficient of all the registered accounts available in Canada, but using the RRSP Home Buyers’ Plan and TFSA can also bring advantages. In fact, you might choose to use all three. The route you choose may depend on your personal situation.

sources: Fidelity.ca – Introducing the tax free home savings account

National bank – What’s the FHSA? and is it the right account for me?

If you’d like to discuss this topic in greater detail or have any questions, please reach out to a

member of your Arbutus Financial Team.