As climate changes, insurance is becoming more complex – and pricey.

The smoke in the air recently has put wildfires in the front of our minds.

It’s been nearly two years since a wildfire roared through Lytton, BC, destroying much of the village. In all, more than $100 million in insured damages have been recorded.

These kinds of costly complex recovery efforts are expected to become more common. Experts say the rise in temperatures will lead to an increase in extreme weather.

The final tally in insurance payouts from this spring’s wildfire season won’t be known for some time, but all signs point to another pricey period for the industry.

The federal government expects higher-than-normal fire activity across most of Canada through to August.

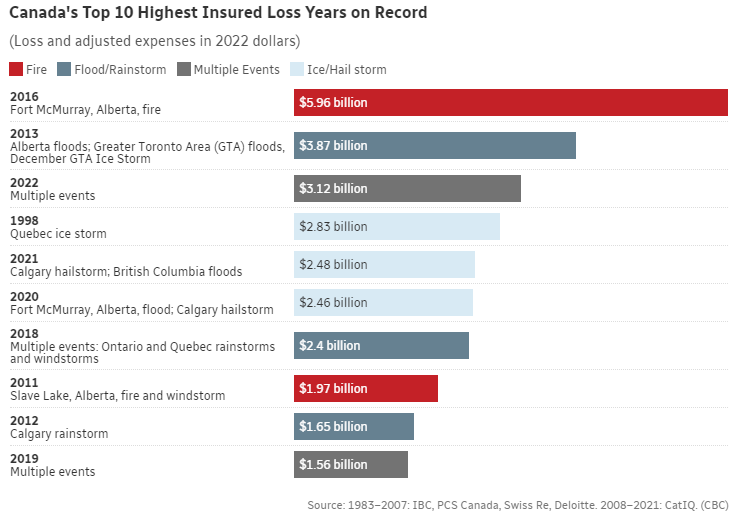

Last year was the third most costly on record in Canada, with $3.1 billion in insured damages as a result of floods, rain, snow storms, and a cyclone in Eastern Canada.

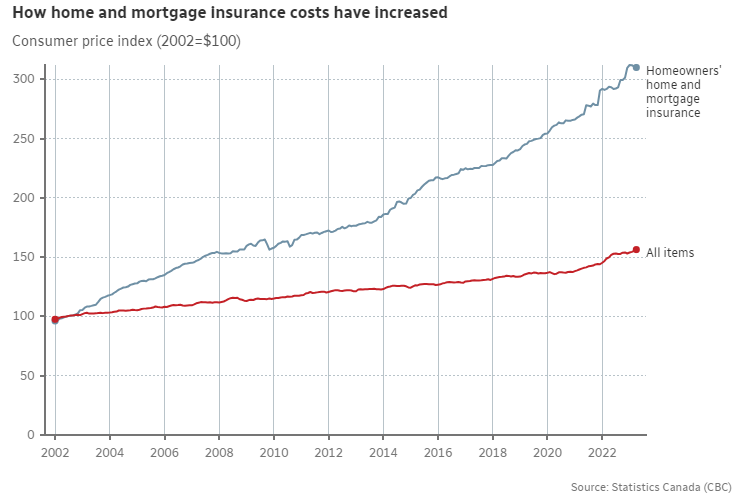

Home insurance rates are on the rise and likely to climb further in the coming years – partially due to the anticipated increase in extreme weather. If there is more money being paid out by insurance companies, then there has to be a way to recover those losses. More claims paid out means more rate increases.

Home insurance and mortgage insurance have climbed an average of 33% over the past 5 years.

A warning sign from California

Canada isn’t yet in the perilous situation now seen in the United States. In California, the insurance company State Farm recently announced it would stop selling new insurance policies amid a growing likelihood of wildfires.

The company said it made the decision due to “historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure and a challenging reinsurance market.”

For now, Canada isn’t at risk of a similar move among insurance companies when it comes to wildfires. Insurers in Canada still treat them as accidents. The costliest extreme weather event in Canada is flooding. In this year’s federal budget, the federal government set aside $31.7 million for a national flood insurance program aimed at covering high-risk properties that have struggled to get flood insurance.

The insurance industry has pressed for years for such a program so that residents in high-risk flood zones are covered.

The federal government said its “low-cost flood insurance program” is aimed at “protecting households at high risk of flooding and without access to adequate insurance.”

In the future, similar programs may be needed to cover other kinds of events, including wildfires.

Source: CBC News https://www.cbc.ca/news/canada/climate-change-insurance-fires-1.6863796

It’s important to regularly review all your insurance plans to keep them current and to be clear what they protect and do not protect. With our partner firms, we have plenty of resources to help you make informed decisions.

For more information on this, or anything else, reach out to your Arbutus Financial team member.

Further Reading:

Federal data forecasts grim wildfire season this summer

If we’re going to tackle wildfires, we need to think differently, say those who know