February is Psychology month in Canada. It is celebrated every February to highlight the contributions of Canadian psychologists and to show Canadians how psychology works to help – people live healthy and happy lives, communities flourish, employers create better workplaces, and governments develop effective policies.

In honor of psychology month – let’s dive into different personality types around money.

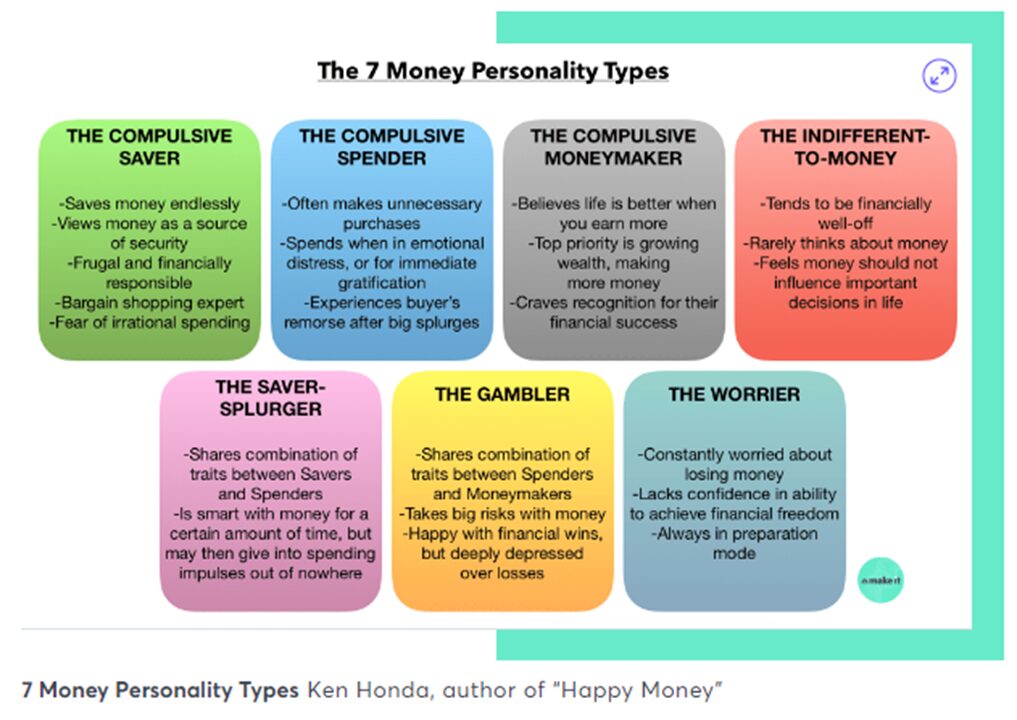

There are 7 money personality types. Which one are you?

We often stress about the importance of financial literacy, such as gaining a strong understanding of how money works and having the resources to make informed decisions.

But when it comes to establishing financial health, one thing most people fail to consider is their money personality type – or their approach and emotional responses to money.

We each have our own beliefs and emotions about money, and they are mostly shaped by our individual life experiences (e.g., passed down from our parents or influenced by our current situations).

While there 7 distinct money personality types, typically people fall into a combination of many types, and not just one.

Identifying which types you fall under, and understanding the pitfalls of each, can significantly improve your relationship with money. It can help you do things like spend less on impulse purchases, be better about budgeting, invest wisely and ensure a nice nest egg for retirement.

If you want to learn more about each money personality type, click here to go to the full article.

Of course, for real life personalized advice on this – or any other financial matter – reach out to your Arbutus Financial advisor.